31+ mortgage insurance premium fha

This cost can be paid at settlement or financed with the FHA loan. The amount youll pay for both depends on your loan amount.

New Bill Aims To End Fha Mortgage Insurance Premiums For Life Policy

Web The Biden Administration has announced that it will cut mortgage insurance premium fees by 030 of a percentage pointfrom 085 to 055for mortgages backed by the Federal Housing.

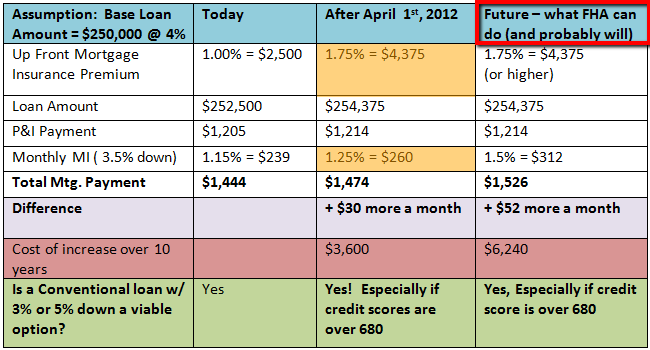

. 175 percent or 3500. The initial FHA mortgage insurance cost is 175 of the loan amount. Web Mortgage Insurance MIP for FHA Insured Loan.

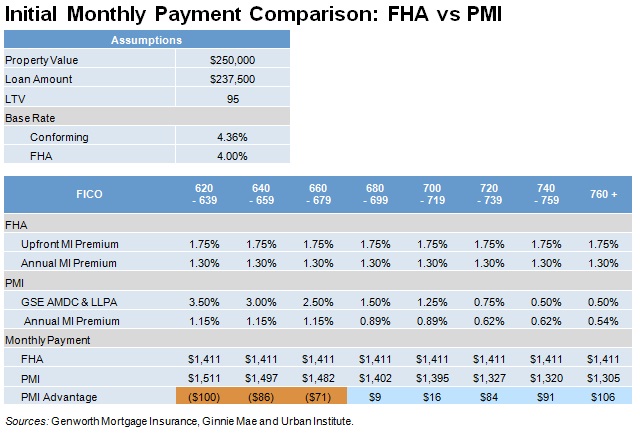

Mortgage insurance is a policy that protects lenders against losses that result from defaults on home mortgages. Web The mortgage insurance premium is the monthly fee that homeowners with FHA-insured mortgages pay to insure their mortgages which they pay on top of their monthly principal and interest. The down payment percentage is based on the loan amount without the UFMIP so a minimum 35 percent down payment would still be 7000 not 712250.

Include that premium in your FHA closing costs if you have the cash. This is exciting news for homebuyers wishing to purchase a home using an FHA. Your FHA loan MIP will involve two payments.

Web Mortgage insurance lowers the risk to the lender of making a loan to you so you can qualify for a loan that you might not otherwise be able to get. Web The US. New Annual Mortgage Insurance 055 of Loan Amount.

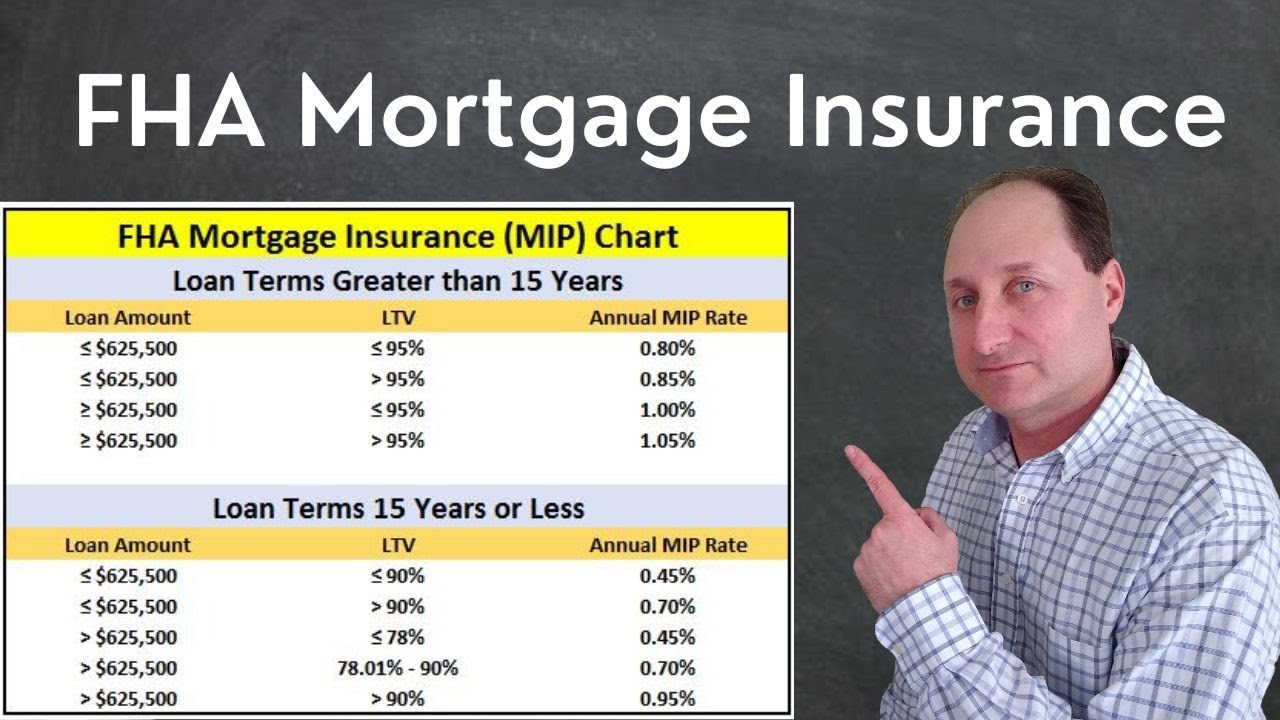

Web There are two components to FHA mortgage insurance. Web FHA mortgage borrowers usually pay 175 of their loan amount in upfront mortgage insurance. Lenders must remit upfront MIP within 10 calendar days of the mortgage closing or disbursement date whichever is later.

For example youll save 1200 annually if your FHA home loan is 400000 under the new rule. Department of Housing Urban Development HUD through the Federal Housing Administration FHA has announced a 30-basis-point reduction to the annual mortgage insurance. Web How much is FHA mortgage insurance.

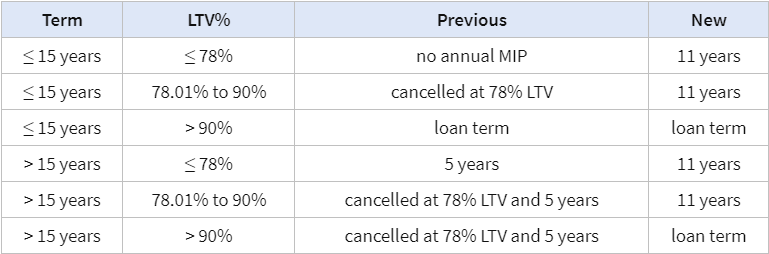

Web Mortgage insurance protects lenders because low down payment loans are riskier than loans where borrowers have more equity. Web Because FHA mortgages allow for down payments as low as 35 for borrowers with a credit score as low as 580 mortgage insurance is required for all FHA home loans. Web Mortgage insurance premium MIP is paid by homeowners who take out loans backed by the Federal Housing Administration FHA.

On a 101750 30-year fixed-rate FHA loan at 4 percent your monthly mortgage payment excluding homeowners insurance and property taxes. 100000 X 055 550 Or 4583 per Month Homeowners are slated to save an average of 800 per year as a result of this reduction in FHA mortgage insurance premiums. Take the sales price and subtract the down payment.

Web Naturally that increases your monthly payment as well. If youre borrowing 250000 for example your upfront MIP will be 4375 250000 x 175 4375. Loan amount with UFMIP included.

FHA requires both upfront and annual mortgage insurance for all. This page provides links to information on the collection and processing of upfront MIP payments for all. Web Heres an example of how to calculate the upfront mortgage insurance premium.

Web Heres an example of how UFMIP is added to the loan. The 175 UFMIP applies to most FHA loans no matter the loan amount or term except for. Web In simpler terms the rate of savings totals 300 per year for every 100000 on a mortgage.

Web WASHINGTON - Today the Department of Housing and Urban Development HUD through the Federal Housing Administration FHA announced a 30 basis point reduction to the annual mortgage insurance premiums annual MIP charged to homebuyers who obtain an FHA-insured mortgage. Web A Federal Housing Administration-backed loan requires an upfront premium or fee of 175 of the loan amount. Web The mortgage insurance premium is the monthly fee homeowners with FHA-insured mortgages pay to insure their mortgages.

Your MIP upfront payment will be equal to 175 of the total value of your loan. The mortgage insurance youll pay on an FHA loan is simply referred to as a mortgage insurance premium or MIP. The reduction could save 850000.

Department of Housing and Urban Development HUD announced that it will be reducing annual mortgage insurance premiums MIPs for certain home loans saving FHA loan borrowers an average of. Mortgage insurance also is typically required on FHA. The premium reduction will take effect on March 20 and will be reflected in the Presidents Fiscal Year 2024 Budget the White House said.

It will reduce the annual premium from 085 to 055. So if you borrowed 150000 youd be required to. The cost of this up front premium is 175 of the loan amount.

First theres an upfront mortgage insurance premium of 175 of the total loan amount. They then have also paid an 085 annual premium which is added to the monthly mortgage payment. An upfront premium and an additional annual payment.

Otherwise you can pay entirely in cash up front but you cant split. Web The move affects mortgage insurance premiums paid by new borrowers who take out loans insured by the Federal Housing Administration. PMI Private Mortgage Insurance.

Web Earlier this morning HUD released details of a long-anticipated plan to reduce the annual MIP mortgage insurance premiums that are currently charged to FHA borrowers by 30 Basis Points. Web The plan will cut mortgage insurance costs by 30 for buyers who take out Federal Housing Administration-backed mortgage loans from 085 to 055. Base loan amount 193000 200000 - 7000.

Web February 23 2023 On February 22 the US. The fee is paid on top of the monthly principal and interest payments. Web Upfront mortgage insurance premium MIP is required for most of the FHAs Single Family mortgage insurance programs.

Sales Price 200000. 3 FHA-backed lenders use MIPs to protect themselves against. If you choose to to roll this cost into your loan you must do so for the whole amount.

Beginning March 20 2023 that 085 will be reduced to 055. Typically borrowers making a down payment of less than 20 percent of the purchase price of the home will need to pay for mortgage insurance. Web After the FHA Mortgage Insurance Premium Reduction.

Web How Much Is An FHA Mortgage Insurance Premium. The upfront mortgage insurance premium costs 175 of your loan amount and is due at closing.

Fwp

Biden Still Likely To Cut Fha Premiums In The Future Analysts Say National Mortgage News

Queens Ny July 22 2022 Queens Properties Magazine By Queens Properties Magazine Issuu

Fha Mortgage Insurance For 2023 Estimate And Chart Fha Lenders

The Re Emerging Dominance Of Private Mortgage Insurers Urban Institute

Fha Requirements Mortgage Insurance For 2023

Fha Requirements Mortgage Insurance For 2023

Fha Increases Cost Of Mortgage Insurance Premium In 2012 Now What

What Is Fha Mortgage Insurance Moneygeek Com

Comparing Private Mortgage Insurance Vs Mortgage Insurance Premium

Understanding Mortgage Insurance Home Loans

Fha Mortgage Insurance Guide Bankrate

Fha Mortgage Insurance Who Needs It And How Much It Costs Forbes Advisor

Private Mortgage Insurance Friend Or Foe

Fha Mortgage Insurance For 2023 Estimate And Chart Fha Lenders

Top 5 Fha Pmi Private Mortgage Insurance Questions Explained

Fha To Cut Mortgage Insurance Premium By 30bps Nmp